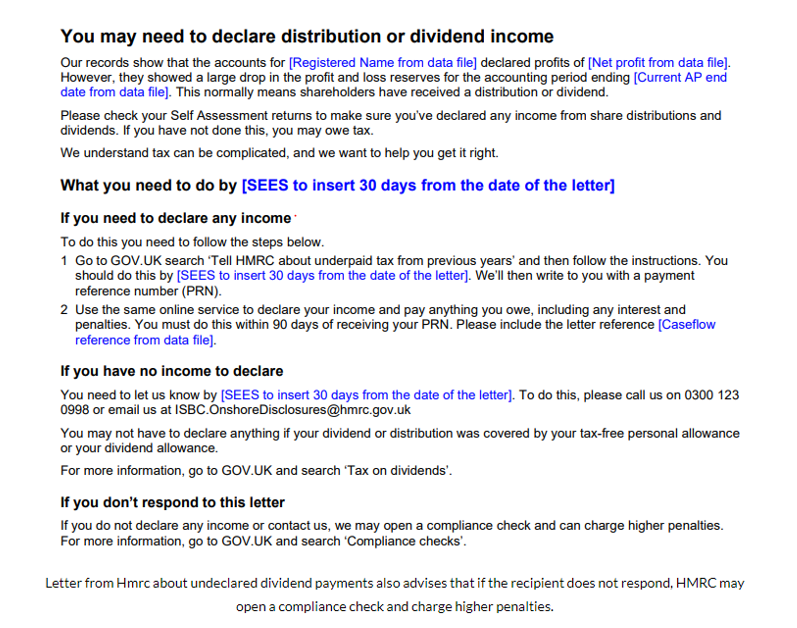

In recent weeks, individuals, especially business owners, have received letters from HMRC—refer to the example below—prompting a review of reported dividends on personal tax returns. This heightened scrutiny stems from HMRC’s ongoing investigations into company reserves, specifically focusing on cases where reported profits don’t align with diminished profit and loss account reserves.

Understanding Dividends:

A dividend is a payment made by a profitable company to its shareholders. It’s important to note that dividends are not considered business expenses for Corporation Tax purposes. A company is restricted from paying out more in dividends than the available profits for the year or reserves from prior financial periods.

To pay a dividend a company must:

- Conduct a directors’ meeting to formally declare the dividend.

- Document the meeting minutes.

- Retain a detailed dividend voucher specifying the date, company name, shareholder names, and the dividend amount.

Tax Implications:

While the company itself doesn’t pay tax on dividends, shareholders may be subject to income tax if their dividends exceed £1,000. Notably, this dividend personal allowance is set to reduce further to £500 starting from April 6, 2024.

Disclosing Undeclared Dividends:

If a review of your company accounts reveals undeclared dividend payments, prompt action is necessary. Utilise HMRC’s disclosure service to inform them about any oversights. A government gateway account is required to make the disclosure.

Understanding and responding to HMRC letters can be complex. At Whittaker & Co, we can help you decipher HMRC’s inquiries, guiding you through the process of preparing and submitting the necessary information.

For personalised support, feel free to contact us via telephone at 01686 610662 or through email at info@whittakerandco.com.